The Complete Guide to Building Tax-Free Wealth, Flexibility, and Protection for Every Stage of Life

Tired of worrying about taxes, market crashes, or whether your retirement plan will be enough? This guide shows you how to build tax-free income for life — with a strategy that protects your money, gives you control, and works no matter where you are in your financial journey.

Introduction: Why Tax-Free Matters More Than Ever

With taxes expected to rise, market volatility increasing, and retirees living longer, the traditional approach to retirement is outdated and dangerous. In this comprehensive guide, you'll learn:

-

Why pensions, 401(k)s, and even Roth IRAs may not be enough

-

How to build your own tax-free financial system using a proven strategy

-

What families, professionals, young adults, and pensioners can do now to protect their future

Common Pitfalls in Retirement Planning

❌ Overestimating how far taxable income will stretch

❌ Underestimating the impact of inflation

❌ Assuming a Roth or 401(k) is enough

❌ Believing you'll be in a lower tax bracket in retirement

❌ Ignoring the cost of losing access to your own money

This strategy was designed to solve those problems—giving you control, protection, and peace of mind.

Seven Tax-Free Strategies to Build Lifetime Retirement Income

1

Build a Personal Financial System Using a Cash Value Life Policy

-

Tax-deferred growth

-

Tax-free access through policy loans

-

Protection for your family

-

Liquidity without penalties

2

Shield Yourself from the Tax Trap of Pension & Social Security

-

Avoid bumping into higher tax brackets

-

Keep Medicare premiums low

3

Unlock Roth-Like Benefits—Without Roth Limits

-

No income restrictions

-

No contribution caps

-

No RMDs

4

Use Your Money When You Need It

-

Withdraw tax-free for emergencies, business, education

-

No age restrictions or penalties

5

Combine Wealth Building and Family Protection

-

Built-in death benefit

-

Skips probate and taxes

6

Beat Inflation with Predictable Growth

-

Fixed or market-linked growth with 0% floor

-

Compounds even when you access funds

7

Eliminate RMDs and Stay in Control

-

No forced distributions

-

Maximize tax-free legacy and income flexibility

Visual Timeline: Start Early, Retire Smarter

Start Now — and You’ll Thank Yourself Later

Assumptions: $250/month from age 25, maintained consistently.

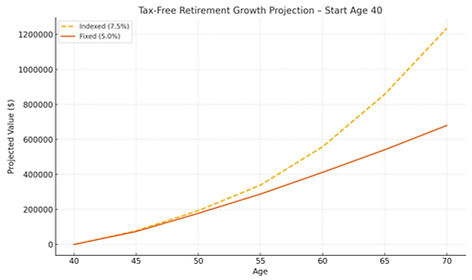

Assumptions: $500/month from age 40, maintained consistently.

Indexed projections assume a 7.5% historical average with a 0% floor and capped upside. Fixed growth assumes 5.0% annually. Outcomes vary based on policy design, underwriting, and contribution levels.

Real-World Examples by Life Stage

Sandra, 63 (Pensioner)

As a retired school administrator, Sandra relied on a taxable pension and Social Security. She didn’t anticipate how much of that income would be eaten up by taxes and rising Medicare premiums. By adding this strategy, she created over $1,200/month in supplemental tax-free income and reduced her RMD pressure.

What She Got Wrong: She assumed her pension and Social Security would be enough.

How This Helped: With tax-free access and guaranteed compounding, Sandra preserved more of her income without triggering a higher tax bracket.

Jason, 45 (High Earner):

Jason, a consultant earning over $250,000/year, had already maxed out his 401(k) and was ineligible for a Roth IRA. He started contributing $15,000/year to this strategy. By age 65, he's on track to access $50,000/year in tax-free income without market losses.

What He Got Wrong: He believed Roth IRAs were his only option.

How This Helped: The strategy provided unlimited, tax-advantaged contributions and a source of liquidity he can use before retirement.

Maria & Derek, 38 (Family):

Both working full-time and raising two children, Maria and Derek began saving $400/month into this strategy. When their oldest started college, they accessed $20,000 in tax-free loans while their account continued growing in value.

What They Got Wrong: They thought retirement and education funding had to be separate.

How This Helped: The strategy provided flexible funds for their child’s tuition and long-term tax-free growth for retirement.

Alex, 27 (Young Freelancer)

With no access to a workplace 401(k), Alex started saving $250/month into this plan. By 37, he had built over $30,000 in cash value, which he used to support a side business — all without interrupting compounding.

What He Got Wrong: He thought he had to wait until retirement to benefit.

How This Helped: Alex discovered that early contributions and policy loans gave him the freedom to grow wealth while staying flexible and self-funded.

See How the Tax-Free Retirement Strategy Works

Tax-Free Retirement Strategy FAQs

Q: Isn’t this just life insurance?

A: No. It’s structured for tax-free growth, liquidity, and protection — not death benefit only.

Q: What if I need money before retirement?

A: Access your funds at any time, tax-free, through policy loans.

Q: Is this better than a Roth IRA?

A: For many, yes. No income limits, no contribution caps, no RMDs, plus death benefit.

Q: Do I have to repay loans?

A: Optional — you’re never forced to repay. Unpaid loans reduce the death benefit.

Q: Can I lose money?

A: No. It’s protected from market losses by contract.

Q: Do I need to qualify medically?

A: Yes. Simplified underwriting applies. The younger and healthier you are, the more efficient it is.

Efficiency Comparison Table